Is Bitcoin Mining Worth It In 2024? (Updated)

November 10, 2024

7 Best Solana (SOL) Wallets: Full Comparison (Updated 2024)

November 10, 2024

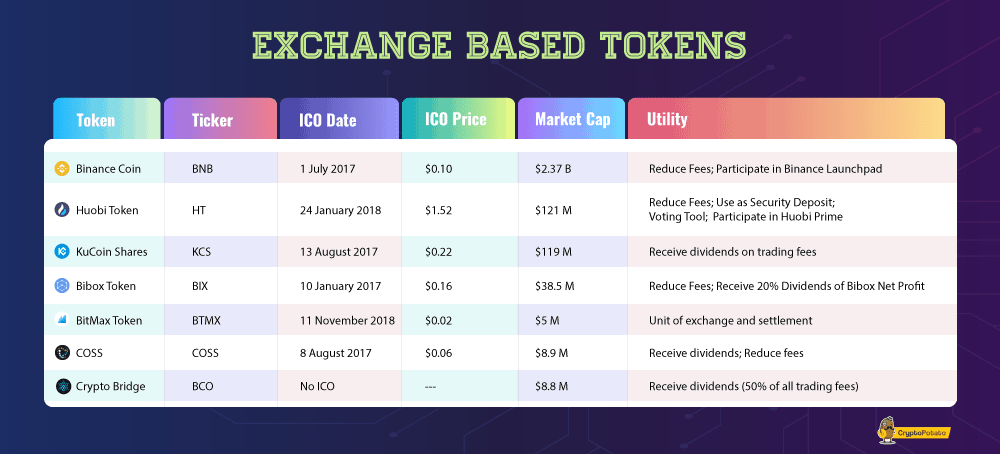

Cryptocurrency change tokens have been round for fairly a while, as platforms discovered a handy method to improve liquidity by offering extra worth to their native token holders and reductions for buying and selling charges.

Nonetheless, 2019 has turned out to be notably fruitful for the foremost change tokens, which have marked notable beneficial properties all through the previous few months regardless of the stagnant total market.

We study a number of the main cryptocurrency change tokens, their worth motion, utility, and total usability.

Binance Coin (BNB)

Binance Coin (BNB) is undoubtedly the preferred change token, because it’s the native cryptocurrency for the world’s main change by way of traded volumes – Binance.

Changpeng Zhao, CEO of Binance, has made it clear on a number of events that their purpose is to “gear BNB with as a lot utility as they will.”

BNB’s major perform and use case is decreasing buying and selling charges on Binance. In different phrases, if customers of the platform decide to pay their buying and selling charges with BNB, they’re supplied with varied reductions.

Furthermore, the coin can also be the one methodology of collaborating within the standard Binance Launchpad fundraising occasions. With sure exceptions, those that wish to take part in these preliminary change choices are solely allowed to buy the offered tokens utilizing BNB, creating substantial demand for the change’s cryptocurrency.

For the reason that starting of the 12 months, Binance Launchpad has seen some profitable token gross sales together with BitTorrent, Fetch.AI, and Celer Community, which had a large impression over BNB’s demand. Just lately Binance had initiated lottery attracts for receiving the correct to take part in future Launchpads IEOs.

Current Binance Launchpad IEOs

Huobi Token (HT) – Huobi

Huobi is yet one more main crypto change. In keeping with knowledge from CoinMarketCap, it has an adjusted day by day buying and selling quantity of $463 million on the time of this writing. The platform was based in 2013 and reportedly turned the main digital asset buying and selling platform in China at the moment. It has seen investments from main and marquee VCs akin to Sequoia Capital.

As Cryptopotato reported originally of this 12 months, the cryptocurrency change launched its personal interchangeable stablecoin known as HUSD.

Huobi Token (HT) was introduced with a number of attention-grabbing use instances. Naturally, considered one of them is to cut back buying and selling charges on the platform, very similar to BNB. Moreover, it may be used as a safety deposit to grow to be an authorized OTC dealer on Huobi. It will also be used as a voting instrument with regards to deciding the itemizing of recent cash on the change.

Huobi introduced the launch of the same blockchain undertaking launching platform named Huobi Prime. Not like Binance Launchpad, nevertheless, Huobi Prime has stated that it’ll have an eligibility criterion that requires traders to carry a day by day common of 500 HT for not less than 30 days previous to the fundraising occasion. The transfer, after all, is more likely to incentivize additional HT holding.

In reality, the platform had already seen the success of its very first token sale. The undertaking was TOP community, and it reached its designated arduous cap in a matter of seconds. For this primary sale, Huobi didn’t implement the five hundred HT minimal holding requirement.

KuCoin Shares (KCS)

Maybe one cause KuCoin gained important traction in early 2018 was that it was itemizing less-known and smaller-cap cryptocurrencies that, on the time, extra main bills refused to checklist.

Nonetheless, the change boasts a reported day by day buying and selling quantity of round $15 million, in response to Coinmarketcap.

The change launched its native token, KuCoin Shares. Because the title stipulates, it entails asset allocation. The change distributes 50 p.c of its buying and selling charges day by day to KCS token holders, which is considerably of a dividend payout scheme.

Extra curiously, leaping on the IEO bandwagon, KuCoin lately introduced that it additionally intends to launch KuCoin Highlight, a blockchain undertaking launch platform much like Huobi and Binance.

KuCoin Highlight had a profitable first sale of a undertaking known as MultiVAC.

OKEx Token (OKB)

OKB is the native token of one other main cryptocurrency change – OKEx. OKB is the utility token which is issued by the OK Blockchain Basis. The token didn’t have an preliminary coin providing or any type of public fundraising.

OKB is an ERC-20-based utility token that’s touted to be transitioned to OKEx’s public blockchain, OKChain, sooner or later.

One factor to notice is that OKEx launched a token-sharing system that gave away 60% of all OKB tokens to OKEx customers without spending a dime.

The principle options of the OKB token are eliminating transaction limitations and rising operational effectivity inside its ecosystem.

One of many issues to contemplate, nevertheless, is that traders who’ve over 500,000 OKB locked in escrow get to overview and endorse itemizing candidates on the change, which is a pleasant utility.

Just like the talked about exchanges, OKEx initiated its fundraising platform below the title OKEx Jumpstart. Their first deliberate token sale is Blockcloud.

Bibox Token (BIX)

Bibox shouldn’t be among the many prime exchanges by quantity; nevertheless, it focuses on the Asian market. The platform noticed some traction in early 2018 because it started itemizing a number of the extra standard Asian-based tokens. It’s additionally probably the most important markets for DAI, the stablecoin.

The platform additionally has its native coin, BIX, which is ticked as such and has a number of use instances. First, BIX holders can profit from lowered buying and selling charges—a mannequin that, as we noticed above, is usually used.

Moreover, it additionally gives 20% dividends primarily based on the Bibox change’s web revenue. Just lately, Bibox introduced its exchange-based fundraising platform, Bibox Orbit.

BitMax Token (BTMX)

BitMax is a comparatively lesser-known digital asset buying and selling platform. Nonetheless, Coinmarketcap exhibits a day by day buying and selling quantity of $56 million on the time of this writing, inserting it because the forty seventh largest cryptocurrency change.

The change’s native token is BitMax Token, which carries the BTMX ticker. In keeping with the undertaking’s whitepaper, BTMX “doesn’t in any method symbolize any shareholding, participation, proper, title, or curiosity” within the firm. The doc additionally stipulates that the token received’t “entitle token holders to any promise of charges, dividends, income, earnings or funding returns.”

As such, the principle thought behind BTMX is to function a unit of change and settlement between contributors who work together with BitMax’s ecosystem.

Different Alternate Tokens to Point out

The above are a number of the well-known and standard cryptocurrency change tokens. Nonetheless, there are additionally others which are attention-grabbing and deserve a worthy point out, primarily as a result of they present that not the whole lot is enjoyable and video games.

COSS

COSS is a cryptocurrency change primarily based in Singapore. Its important thought is to deliver all the mandatory buying and selling functionalities below one roof. Coinmarketcap exhibits that its day by day traded quantity is presently about $10 million.

It additionally has its token, unsurprisingly known as the COSS token. It distributes a certain quantity of the platform’s buying and selling charges to its holders, and it may be used to cut back buying and selling charges—a sample we’ve discovered to be adopted by many.

Crypto Bridge (BCO)

Crypto Bridge is the one one on the checklist that could be a decentralized change constructed on prime of the Bitshares platform. It’s targeted on small-cap Proof of Work (PoW) cash.

The native cryptocurrency of Crypto Bridge known as Bridge Coin (BCO). It may be mined, and it pays out 50% of all buying and selling charges to those that maintain it.

Binance Free $600 (CryptoPotato Unique): Use this hyperlink to register a brand new account and obtain $600 unique welcome supply on Binance (full particulars).

LIMITED OFFER 2024 at BYDFi Alternate: As much as $2,888 welcome reward, use this hyperlink to register and open a 100 USDT-M place without spending a dime!