9 Best Ethereum (ETH) ETFs in 2024: Full Comparison, Fees, Alternatives

November 11, 2024

How to Buy and Sell Your First NFT on OpenSea? A Step-by-Step Guide

November 11, 2024

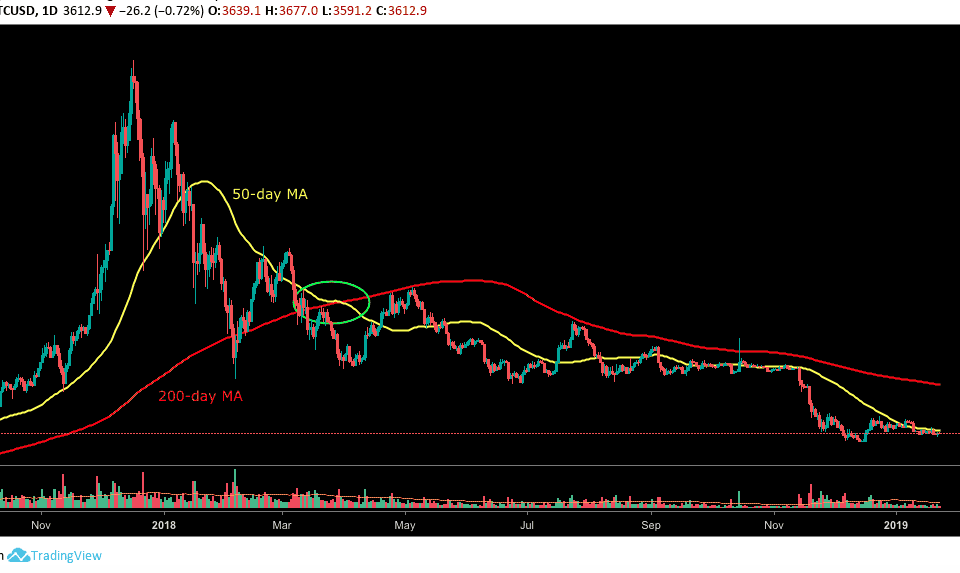

The distinctive traits of the cryptocurrency markets have made technical evaluation and charting invaluable instruments in serving to to foretell route, momentum, and assist & resistance.

This text presents a short define of a few of the extra superior well-liked technical evaluation strategies accessible to research cryptocurrency markets like Bitcoin. In case you are unfamiliar with technical evaluation, please learn our crypto technical evaluation information for inexperienced persons.

Every has its personal traits, and traders are inspired to review every one to find out if it matches their specific buying and selling model and danger tolerance.

Japanese Candlesticks

Japanese candlesticks are a technical evaluation device that could possibly be useful to cryptocurrency merchants as a result of they supply merchants with key information for a number of time frames in single worth bars.

Though cryptocurrencies are extraordinarily totally different from conventional property, they’ve nonetheless charted the identical approach with the worth motion recognized by the open, excessive, low, and shut (OHLC). The OHLC makes use of candlesticks to construct patterns that predict worth route as soon as accomplished.

In response to analysis and back-testing, there are 5 candlestick patterns that carry out exceptionally effectively as precursors of worth route and momentum. Every candlestick sample works throughout the context of surrounding worth bars to foretell greater or decrease costs.

Essentially the most correct candlestick patterns fall into classes recognized as reversals and continuations. Candlestick reversal patterns predict a change in worth route, whereas continuation patterns predict an extension within the present worth motion.

Since cryptocurrencies are inclined to have a powerful upside bias, merchants who need to use candlestick formations to enhance their buying and selling expertise ought to deal with chart patterns that are inclined to predict bottoms or a continuation of the uptrend.

The 5 bullish candlestick patterns that traders needs to be specializing in throughout Bitcoin’s historic bull market rally, for instance, are referred to as The Hammer, The Bullish Engulfing Sample, The Piercing Line, The Morning Star, and The Three Troopers.

The Hammer is a bullish reversal sample, which alerts that an instrument is nearing a backside in a downtrend. Hanging Man – the other.

The Bullish Engulfing Sample is a two-candle reversal sample that seems in a downtrend. The Piercing Line additionally seems in a downtrend:

The Morning Star is taken into account an indication of hope and a brand new starting in a dark downtrend.

The Three Troopers Sample is often noticed after a interval of downtrend or in worth consolidation.

Â

Elliott Wave Evaluation

The Elliott Wave precept is a type of technical evaluation that cryptocurrency merchants use to research market cycles and forecast market tendencies by figuring out extremes in investor psychology, highs and lows in costs, and different collective components.

Elliott Wave merchants imagine that markets are affected by collective investor psychology or crowd psychology and that it strikes between optimism and pessimism in pure sequences.

It appears to be a self-discipline fitted to cryptocurrency merchants as a result of, at the moment, they’re being solely pushed by investor psychology since there aren’t any true underlying fundamentals backing its worth rise aside from aggressive shopping for as a result of restricted provide.

The important thing to success when utilizing Elliott Wave evaluation is to get the wave depend proper. Merchants who use this system imagine the market strikes in waves and that worth motion is primarily pushed by teams of 5 waves as follows:

It takes years to grasp Elliott Wave evaluation, however some cryptocurrency merchants really feel they’ve a adequate grasp of the fundamentals to use it to markets corresponding to Bitcoin.

Fibonacci Ranges

Fibonacci ranges are an offshoot of Elliott Wave Evaluation. Merely acknowledged, it’s a option to discover attainable assist and resistance ranges in a cryptocurrency market.

For instance, after making a excessive/low vary, merchants anticipate a market to retrace 38.2% to 61.8% of this vary to arrange the following potential shopping for or promoting alternative. Each are Fibonacci ranges.

Inversely, after making a backside, for instance, a dealer will attempt to forecast the following rally by making use of arithmetic to the worth motion. Merchants use the Fibonacci degree to estimate the development size and development’s corrections.

Stochastics and Relative Power Index (RSI)

Stochastics and the Relative Power Index (RSI) are identified within the technical evaluation discipline as oscillators as a result of they transfer between a low of 0 and a excessive of 100. Some cryptocurrency merchants use them to find out the power of a development or to foretell tops and bottoms due to overbought and oversold situations. As Bitcoin costs usually commerce in an overbought or oversold situation as a result of its excessive volatility, the RSI indicator alerts merchants to enter or exit a sure place.

They each work beneath the premise that costs needs to be closing close to the highs of the buying and selling vary throughout upswings and towards the decrease finish of a buying and selling vary throughout downswings.

Throughout a chronic transfer down, the oscillators might be close to 0, indicating {that a} backside could also be close to. Throughout a chronic transfer up, the oscillators might be close to 100, indicating {that a} prime could also be close to. Within the connected graph, Bitcoin is presently at 81.92 (RSI), which means that Bitcoin is overbought and a correction is predicted.

MACD or Transferring Common Convergence/Divergence

The MACD is categorized as an indicator. It’s comprised of two exponential shifting averages that assist measure momentum in a cryptocurrency.

The MACD compares short-term momentum and long-term momentum in a cryptocurrency market to sign the present route of momentum relatively than the route of the worth.

When the MACD is constructive, it alerts that the crypto forex’s momentum is upward. The other is true when the MACD is destructive.

Ichimoku Clouds

An Ichimoku Cloud is an indicator that defines assist and resistance areas, identifies development route, gauges momentum, and supplies buying and selling alerts. The “clouds” are fashioned between spans of shifting averages plotted six months forward and the midpoint of the 52-week excessive and low plotted six months forward.

Merely acknowledged, the general development is up when costs are above the cloud, down when costs are beneath the cloud, and flat when they’re within the cloud itself.

Conclusion

When buying and selling cryptocurrencies like Bitcoin utilizing varied technical evaluation instruments, it’s important that you’ve a powerful conviction in what you are attempting to perform as a result of every method outlined on this article has its personal traits.

For instance, in case you are a development dealer and utilizing a development indicator device, you might not need to cloud your evaluation with an oscillator as a result of it might point out {that a} market is overbought or oversold. In different phrases, be taught the traits of every technical device earlier than making use of them to an precise market. With the shortage of fundamentals, utilizing technical evaluation indicators in cryptocurrencies and, particularly, Bitcoin, is important for each crypto dealer.

Environment friendly Technical Evaluation Instruments to start out with

TradingView: It is a well-known graph and charting service with all kinds of choices. Principally free, apart from premium paid options.

Coinigy supplies a complete charting service amongst all buying and selling cash and crypto exchanges. You may register following this hyperlink and get 30 30-day free trial.

CoinAnalyze: Sensible web site that identifies Japanese Candles’ patterns in main cryptocurrencies.

There’s much more (2018)

Learn the continuation information right here, which discusses Bollinger bands, CCI, flags, pennants, and extra.

Binance Free $600 (CryptoPotato Unique): Use this hyperlink to register a brand new account and obtain $600 unique welcome provide on Binance (full particulars).

LIMITED OFFER 2024 at BYDFi Trade: As much as $2,888 welcome reward, use this hyperlink to register and open a 100 USDT-M place free of charge!