15 Must-Read Bitcoin & Crypto Trading Tips (Updated 2024)

November 10, 2024

Top 10 NFT Marketplaces You Should Know in 2024

November 10, 2024

Crypto merchants have a number of instruments to evaluate the cryptocurrency market. Considered one of them is an strategy generally known as Technical Evaluation. Utilizing this methodology, merchants can get a greater understanding of the market sentiment and isolate important traits out there. This knowledge can be utilized to make extra educated predictions and wiser trades.

Tech evaluation considers the historical past of a coin with worth charts and buying and selling volumes, it doesn’t matter what the coin or undertaking does. Versus technical evaluation, basic evaluation is extra centered on establishing if a coin is over or under-valued.

To get a greater concept of technical evaluation, it’s essential to grasp the elemental concepts of Dow Concept that tech evaluation relies on:

- The market considers every little thing in its pricing. All present, prior, and upcoming particulars have already been built-in into present asset costs. On the subject of Bitcoin and crypto, this may be comprised of a number of variables like present, previous, and future demand, in addition to any laws that affect the crypto market. The prevailing worth is a response to all the present particulars, which embody the expectations and data of every coin traded out there. Technicians interpret what the value suggests about market sentiment to make calculated predictions about future pricing.

- Worth motion isnât random. Fairly, they usually comply with traits, which can be lengthyâor short-term. After a coin varieties a pattern, itâs most likely going to comply with that pattern to oppose it. Technicians attempt to isolate and revenue from traits utilizing technical evaluation.

- âWhatâ is extra essential than âWhyâ? Technicians are extra centered on the value of a coin than every variable that produces a motion in its worth. Though a number of features may have influenced the value of a coin to maneuver in a selected path, Technicians assertively assessment provide and demand.

- Historical past tends to get repeated. It’s potential to foretell market psychology. Merchants generally react the identical means when introduced with related stimuli.

Development Strains

Development traces, or the everyday path {that a} coin is shifting in direction of, will be most helpful for merchants of crypto. That stated, isolating these traits will be simpler stated than finished. Crypto property is likely to be considerably risky, and watching a Bitcoin or crypto worth motion chart will most likely reveal a choice of highs and lows that kind a linear sample. With that in thoughts, Technicians perceive that they’ll overlook the volatility and discover an upward pattern upon seeing a collection of upper highs, and vice versa â they’ll establish a downtrend once they see a collection of decrease lows.

Moreover, there are traits that transfer sideways, and in these instances, a coin doesnât transfer considerably in both path. Merchants ought to be aware that traits are available many varieties, together with intermediate, lengthy, and short-term pattern traces.

Necessary tip: you should be correct when drawing these pattern traces! How one can do it completely? As you hover over every candle, you’ll discover the bottom worth of it marked as âLâ within the prime bar (or the very best worth, âHâ, if the roadâs path is down). Now, place your line precisely there. Subsequent, lengthen the road roughly; because it touches the following candle within the pattern line, do the identical â examine precisely the âLâ for that candle. Now appropriate your line. The ultimate step is to auto-extend the road utilizing the roadâs Settings â Line extends to the specified facet (most likely proper). This clarification was for Coinigy charts, nevertheless it ought to work effectively with different chart functions.

Resistance and help ranges

As there are pattern traces, there are additionally horizontal traces that categorical ranges of help and resistance. By figuring out the values of those ranges, we are able to draw conclusions in regards to the present provide and demand of the coin. At a help stage, there appears to be a substantial quantity of merchants who’re keen to purchase the coin (an excellent demand), i.e., these merchants consider that the foreign money is priced low at this stage and, subsequently, will search to purchase it at that worth. As soon as the coin reaches near that stage, a âgroundâ of consumers is created. The massive demand often stops the decline and generally even adjustments the momentum to an upward pattern. A stage of resistance is precisely the other â an space the place many sellers wait patiently with their orders, forming a big provide zone. Each time the coin approaches that âceilingâ, it encounters the provision stacks and goes again.

There’s usually a scenario during which trade-offs will be between help and resistance ranges: gathering near help traces and promoting across the resistance stage. This chance often takes place when lateral motion is recognized.

So, what occurs throughout a breakout of resistance or help stage? There’s a excessive likelihood that that is an indicator strengthening the prevailing pattern. Additional reinforcement of the pattern is obtained when the resistance stage turns into a help stage and is examined from above shortly after the breakout.

Be aware: False breakouts happen when a breakout occurs, however the pattern doesnât change. Therefore, we should use some extra indicators, akin to buying and selling quantity, to establish the pattern.

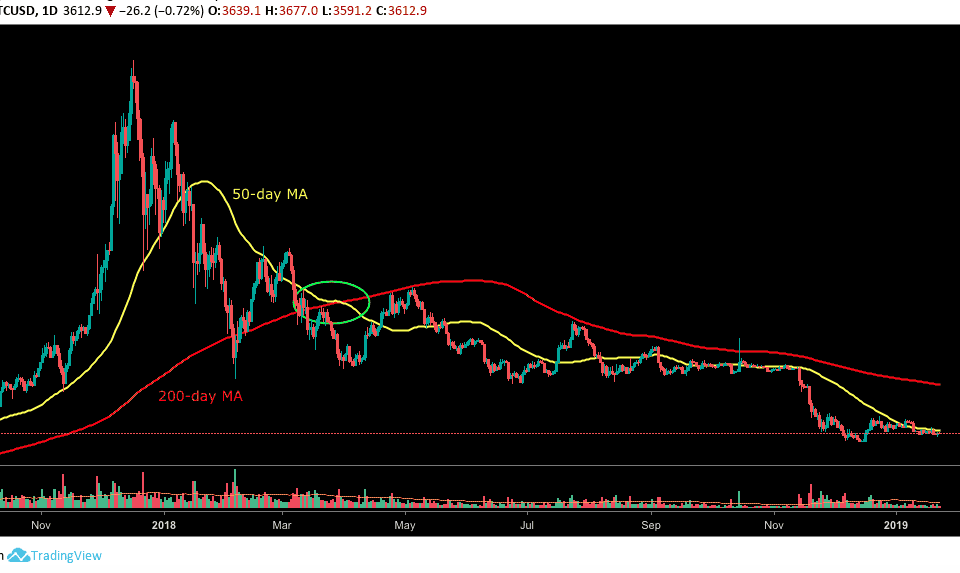

Transferring averages

One other technical evaluation instrument for cryptocurrencies and technical evaluation typically, which simplifies pattern recognition, known as shifting averages. A shifting common relies on the common worth of the coin over a sure time frame. For instance, a shifting common of a given day will probably be calculated in keeping with the value of the coin for every of the 20 buying and selling days previous to that day. Connecting all shifting averages varieties a line.

Additionally it is essential to acknowledge the exponential shifting common (EMA), a shifting common that offers extra weight in its calculation to the value values of the previous few days than the earlier days. An instance is the calculation coefficient of the final 5 buying and selling days of EMA 15 days, which will probably be twice that of the earlier ten days.

The next graph supplies a sensible instance: If a 10-day shifting common crosses above a 30-day shifting common, it’d point out a constructive pattern is coming.

Buying and selling Quantity

Buying and selling quantity performs an essential function in figuring out traits. Important traits are accompanied by a excessive buying and selling quantity, whereas weak traits are accompanied by a low buying and selling quantity. When a coin goes down, it’s advisable to examine the quantity which accompanies the decline. An extended-term pattern of wholesome progress is accompanied by a excessive quantity of will increase and a low quantity of declines. Additionally it is essential to see that quantity is rising over time. If the quantity decreases throughout will increase, the upward pattern is prone to come to an finish, and vice versa throughout a downtrend.

Not on the technical evaluation alone

Utilizing technical evaluation, merchants can establish traits and market sentiment, and so they even have the flexibility to make wiser funding selections. Nevertheless, there are a selection of key factors to contemplate:

Technical evaluation is a sensible methodology that weighs previous costs of sure cash and their buying and selling quantity. When contemplating getting into a commerce, it’s not really helpful that you simply solely depend on technical evaluation. Particularly within the area of crypto, a area that always generates information, there are basic elements which have a major affect available on the market (akin to laws, ETF certificates, mining hash, and so forth.). Technical evaluation solely ignores and mayât predict these elements, so the advice is to combine technical evaluation and basic evaluation to make clever funding selections.

An analyst who decides to purchase a selected coin for basic causes can search technical help or discover a good technical entry level, thus strengthening the commerceâs ROI.

From Concept to Implementation: How one can begin and establish traits?

As a way to get began, we’d like an analytics instrument that pulls graphs shortly and simply. You need to use the prevailing graphs of the crypto exchanges, however they donât present pattern traces, and so they solely present partial indicators.

TradingView: This can be a well-known graph and charting service with all kinds of choices. Principally free, apart from premium paid options.

Coinigy supplies a complete charting service for all buying and selling cash and crypto exchanges. Register utilizing this hyperlink and get a 30-day free trial.

This information introduced the fundamental ideas within the technical evaluation of crypto. It is strongly recommended that you simply deepen your data within the area in case you want to implement tech evaluation: indicators, Fibonacci ranges, patterns (triangles, for instance), and extra. In our following featured article, you’ll examine 8 ideas for buying and selling crypto. Some contact on the technical facet.

December 2017 replace: We lately revealed an superior information for crypto technical evaluation.

Binance Free $600 (CryptoPotato Unique): Use this hyperlink to register a brand new account and obtain $600 unique welcome provide on Binance (full particulars).

LIMITED OFFER 2024 at BYDFi Alternate: As much as $2,888 welcome reward, use this hyperlink to register and open a 100 USDT-M place without cost!