What Are Rug Pulls? How to Avoid Getting Scammed?

November 10, 2024

What Are CryptoPunks and Why Are They So Expensive?

November 10, 2024

Discovering methods to foretell the longer term motion of an asset has at all times been the holy grail of merchants throughout the globe, and crypto merchants aren’t any completely different.

Though there are a number of things that affect the worth of a cryptocurrency in a constructive or destructive means, comparable to reaching milestones, partnership signings, hacker assaults, new rules, and so on. Utilizing this data together with different strategies, comparable to pattern detection, implies that it’s extremely useful to grasp the technical evaluation.

Nonetheless risky the costs of cryptocurrencies could also be, skilled merchants can generally spot distinct motion patterns, permitting them to foretell which means the worth goes to go. Subsequently, we’re going to begin explaining the rudiments with three patterns that merchants can discover when buying and selling on numerous exchanges.

Head and shoulders

The pinnacle and shoulders sample is a formation that may, to the inexperienced eye, seem like a baseline with three peaks.

Nonetheless, the center peak is increased than the opposite two, that are comparable in measurement.

In technical evaluation, a head and shoulders (or H&S) sample predicts a bullish-to-bearish pattern reversal and is considered probably the most dependable pattern reversal patterns, which, if noticed accurately, reveals that an uptrend is nearing its finish.

Because the cryptocurrency market is a continuing battle between bulls and bears, the pinnacle and shoulders sample comes after a interval of the market’s dominance by bulls.

After the primary value stagnation (Shoulder 1), when the worth reaches a brand new excessive (Head), it’s nonetheless attainable that the bulls will take the worth even increased. Nonetheless, after the worth declines for the second time, bulls attempt to push it up once more (Shoulder 2). They don’t succeed, and it turns into evident that bears are beginning to dominate the market – the pattern reverses.

The focused value on this reversal is equally distanced from the neckline, as is the height of the pinnacle, simply in the wrong way (downward).

When buying and selling the pinnacle and shoulders sample, traders shouldn’t assume that the sample goes to type. As a substitute, they need to look ahead to the decline after the proper peak to achieve the neckline after which take a place, taking into account different necessary alerts.

Reversed H & S

There may be additionally a reversed head and shoulders sample, which, opposite to what we described above, marks the tip of the reign of the market’s bears, which must also be waited out till the final shoulder kinds fully earlier than coming into the commerce.

Triangles

Triangles are available three kinds:

- Ascending

- Descending

- Symmetrical

Ascending triangle

Traders spot an ascending triangle by the worth swinging between the fixed line of resistance and rising assist.

The ascending triangle is taken into account to be a strong bullish formation, which may result in large scores if approached the proper means.

These not cautious sufficient can take a place close to the assist line, wanting to reinforce their positive factors, to finish up with a loss as the worth motion turns to the bearish formation of a double or triple prime.

Focused costs will be discovered by trying on the widest distance between highs and lows and utilized up from the breakout level.

Skilled merchants look ahead to a major upward breakout backed by a a lot greater quantity to take a place, as breakouts with out an inflated quantity can catch merchants in a bull entice (like within the chart above).

Descending Triangle

The descending triangle is a typical bearish formation the place the worth motion flows between a gentle assist line and descending resistance, displaying rising distrust towards the crypto asset.

As soon as a downward breakout occurs, it’s the affirmation of the sample, and an investor can anticipate the continuation of the destructive value motion.

As with its ascending counterpart, the goal is the same as the widest swing contained in the formation transferred from the breakout level downward.

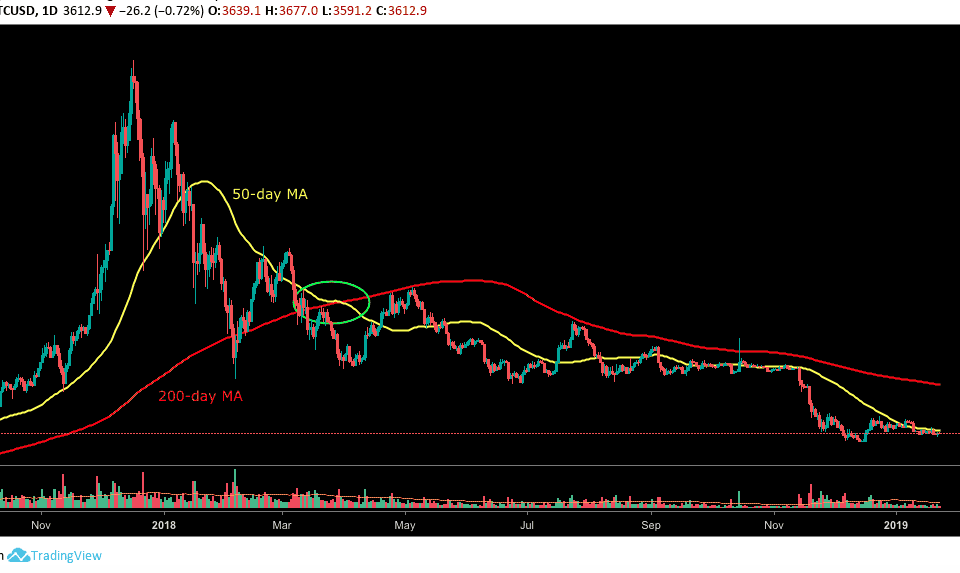

Probably the most well-known crypto descending triangle from latest years is the one from the 2018 Bitcoin chart.

Symmetrical triangle

Now, these triangles are most likely the most typical in cryptocurrency buying and selling and, on the similar time, probably the most unpredictable.

Because the symmetrical triangle reaches its closure, the quantity of buying and selling turns into smaller as merchants are normally indecisive about which place to take. When the battle between bulls and bears resolves, there are two sorts of breakouts attainable – constructive and destructive.

Every of the 2 attainable breakout actions shall be adopted by a a lot greater quantity than whereas the motion was reaching the triangle’s peak. Subsequently, merchants must maintain an in depth eye on the north/south breakout factors and act accordingly.

As soon as the breakout occurs, a dealer can deduce the goal by drawing a parallel with the alternative facet of the place the breakout occurred. Connecting that parallel line with the bottom of the triangle, the dealer then transcribes the space between the opening of the triangle to that parallel from the breakout level to mark the focused value.

Wedges

Wedges are additionally quite common formations in crypto buying and selling and are broadly thought-about a number of value wave reversal patterns.

That implies that, inside a wedge, the worth motion swings from highs to lows a number of instances till it breaks out of the sample.

There are two sorts of wedge formations:

Rising wedge

Not like the ascending triangle formation, within the rising wedge, the worth swings journey by means of highs and lows, that are each getting increased. It’s a formation that says {that a} bullish pattern will reverse into a robust bearish sentiment.

Normally, the worth vary of the wedge’s opening reveals the minimal value decline after the eventual downward breakout.

Falling wedge

The falling wedge formation seems to be just like the mirror picture of the rising wedge, however it’s thought-about to be saying a bull run as soon as the eventual reversal occurs.

It’s advisable for merchants to attend for the affirmation of the breakout earlier than taking the lengthy place, because the bullish sentiment after the falling wedge will be vital.

The minimal focused value for the descending wedge is the precise reverse of its ascending counterpart.

You will need to observe that, within the cryptocurrency market, peaks don’t essentially must comply with highs and lows in an actual straight line, however they’re shut sufficient within the value vary to mark the formation.

Binance Free $600 (CryptoPotato Unique): Use this hyperlink to register a brand new account and obtain $600 unique welcome supply on Binance (full particulars).

LIMITED OFFER 2024 at BYDFi Alternate: As much as $2,888 welcome reward, use this hyperlink to register and open a 100 USDT-M place free of charge!