Filipinos turn to virtual-assistant roles in post-COVID job market

September 4, 2025

5 Jobs AI Will Practically Own By 2026

September 7, 2025

Each week, Zikoko seeks to grasp how folks transfer the Naira out and in of their lives. Some tales will likely be struggle-ish, others will likely be bougie. On a regular basis, it’ll be revealing.

Uninterested in the stress of transferring cash throughout borders? With Juicyway, you possibly can seamlessly ship, obtain, and convert fiat or stablecoins like USD, CAD, USDT, and USDC in Nigeria—at nice charges. Free multi-currency accounts, immediate transfers, and top-tier safety? Say no extra. Click on right here to get began!

What’s your earliest reminiscence of cash?

I don’t have any deep story about cash as a baby. I simply know my mother and father supplied all I wanted. I obtained the standard Christmas cash from family, and I vaguely bear in mind my mum giving me some money in main 5 to purchase no matter I needed on the grocery store. That’s about it.Â

Inform me extra about your mother and father. What did they do for cash?

My dad’s a veterinary physician, and my mum consults for NGOs. We weren’t wealthy like that; simply middle-class. Nevertheless, my mother and father ensured that my siblings and I didn’t lack any requirements.

For example, my dad doesn’t imagine in allowances. I attended a non-public college that didn’t permit college students to cook dinner — we solely purchased meals — so my dad was apprehensive that if I needed to handle cash, I wouldn’t eat and threat dropping the barely-there weight I had.Â

It was my mum who insisted on an allowance. She mentioned I wanted to be accountable with spending cash. So, from after I entered uni in 2018, I acquired a ₦30k allowance. If the cash completed earlier than the tip of the month, I might name house for the additional ₦5k or ₦10k.

I survived on my allowance till the second semester of my ultimate yr in 2022, after I realised I might receives a commission for writing.

How did writing come into the image?

I’ve written all my life. At 15, I used to be writing Wattpad-ish tales for the sake of it.Â

Writing for cash occurred as a result of a few of my elder sister’s classmates relocated to check overseas. Their assessments primarily consisted of essays and articles, they usually incessantly sought my sister’s assist. She determined to monetise it, and he or she recruited me to hitch. We had about 10 purchasers, so each time it was faculty season overseas, we made cash.Â

How a lot cash are we speaking?

We used to cost primarily based on the size of the essay: ₦10k for an essay of 1k phrases, and ₦20k if it was as much as 2000 or 2500 phrases. My sister gave me the freedom to determine how a lot I needed to cost. So I charged extra for matters I didn’t like or those who required plenty of analysis.

Though the purchasers had been overseas, the negotiations and funds had been made in naira. I’m unsure which channel they used to ship cash, however they typically despatched it to my sister, who then forwarded it to me. One of many purchasers had a member of the family in Nigeria, in order that particular person dealt with the cost for them, because it was extra easy.Â

Through the faculty season, I wrote a mean of two articles per week and earned between ₦20k and ₦25k. The cash was bonus revenue. I used it for issues like make-up and final-year week actions.Â

Should be good

In 2023, the excessive greenback alternate price turned a factor. Perhaps it was simply me, however earlier than then, the alternate price wasn’t one thing folks talked about typically.

However that yr, I started to listen to that the greenback alternate price was going up, so we adjusted our pricing. My lowest cost for an article elevated from ₦10k to ₦15k. Sadly, the gigs led to 2023. Our purchasers graduated, and we didn’t get anybody else.

By this time, I had been mobilised for NYSC. I graduated from uni in direction of the tip of 2022 and went for NYSC nearly instantly. My Place of Major Task (PPA) was at a federal polytechnic, and I didn’t do something significant there.Â

I sat in an workplace gathering recordsdata and documenting registrations for ₦6k/month. They typically owed, so typically I’d go three months with out pay, then obtain the entire ₦18k in a single go. A minimum of the ₦33k NYSC stipend got here frequently. The one advantage of the whole yr was that I lived at house and went to work from there.

What occurred after NYSC?

I landed my present digital assistant job two weeks earlier than I completed NYSC in October 2023. The way in which the job got here was a miracle, really. It was my first stab at digital help.

My sister labored with the corporate, which is a US-based firm, and he or she was planning to relocate. Since I used to be nearly accomplished with my NYSC, she really helpful me for the position.Â

The HR was like, “If it’s this one who really helpful you, then no drawback.” I interviewed on a Thursday and obtained the supply the next Tuesday.

Good. What’s the pay like?

It’s an hourly cost schedule. Once I first joined, I labored solely 20 hours per week at $2/hour. Then it elevated to 40 hours at $4/hour after a month.Â

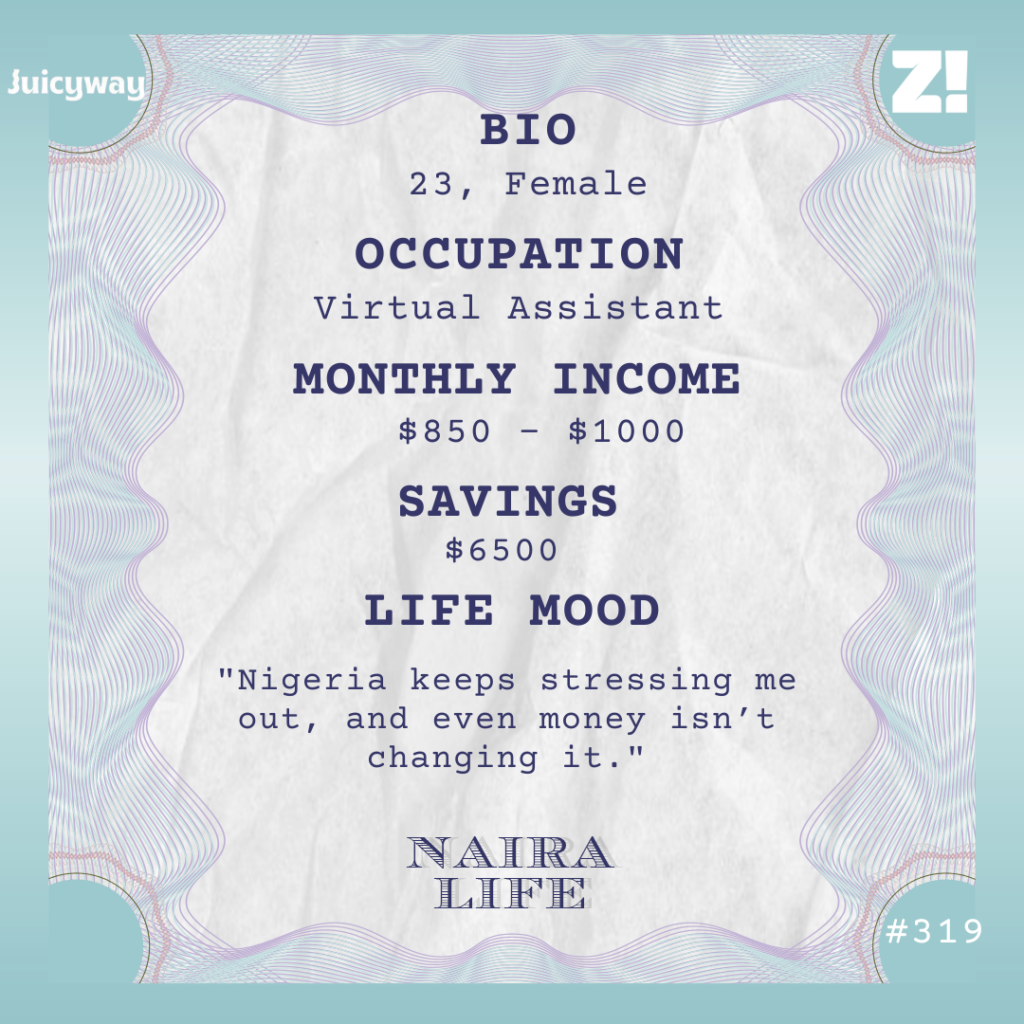

Then, in 2024, I moved to 50 hours every week at $4 per hour, typically $4.25, relying on whether or not I do further work. That’s my present pay construction, and my month-to-month revenue ranges between $850 – $1k. My final cost was $917.

However receiving the cost is one other factor. The corporate has an account officer in Nigeria who calculates my wage and sends it to my conventional financial institution’s domiciliary account. Then, after I want cash, I’ve to go to the financial institution to withdraw {dollars} and alternate them on the black market.Â

I do that after a month to keep away from the stress of adjusting a number of instances. I used to vary $200 – $250 to get me by way of the month, however with inflation, I now convert $300, which was ₦474k this month. I depart the remaining within the financial institution.

It appears like a really guide course of

Nicely, I can’t legally transact with {dollars} in Nigeria. I’m unable to switch the cash as a consequence of authorities restrictions. One drawback of this course of is the frequent fluctuation of the alternate price. I can go right now to transform {dollars} and listen to two days later that the greenback is now dearer, so it appears like I’ve wasted cash. I can’t say for certain when the most effective time to transform my cash is.

Additionally, I’ve a problem with investing. Earlier this yr, a few of my colleagues and I talked about investments, so I made a decision to look into it. I assumed it was only a matter of placing cash in a single funding utility and popping out. However I noticed an funding platform that promised 7% yearly curiosity on greenback financial savings. So, if I save $100, I solely get $107 on the finish of the yr. It didn’t make sense to me.

Different platforms required me to transform to naira first to make use of their greenback financial savings and funding choices. Like, they’ve greenback choices, however I can’t ship {dollars} to them. I’ve to vary to naira, purchase {dollars} at their price on their platform, get curiosity, after which convert once more to naira at no matter price they provide if I wish to withdraw.Â

It’s a complete lot for a continually altering conversion price, and I’ll inevitably find yourself being the loser. So, proper now, I’m simply taking a look at my cash within the financial institution.

Phew. That’s so much to absorb. Let’s return to the way it feels to have gone by way of such a major revenue bounce

It didn’t even initially click on that I’d moved from incomes ₦33k to incomes in {dollars}. I believe it was a delayed response as a result of it wasn’t till three months into the job that I realised, “This factor is actual.”Â

Perhaps if I’d been praying for it, I’d have rehearsed how I’d react in my head when it lastly got here. However I simply discovered myself in a brand new monetary scenario. I used to be very shocked, but in addition actually glad.Â

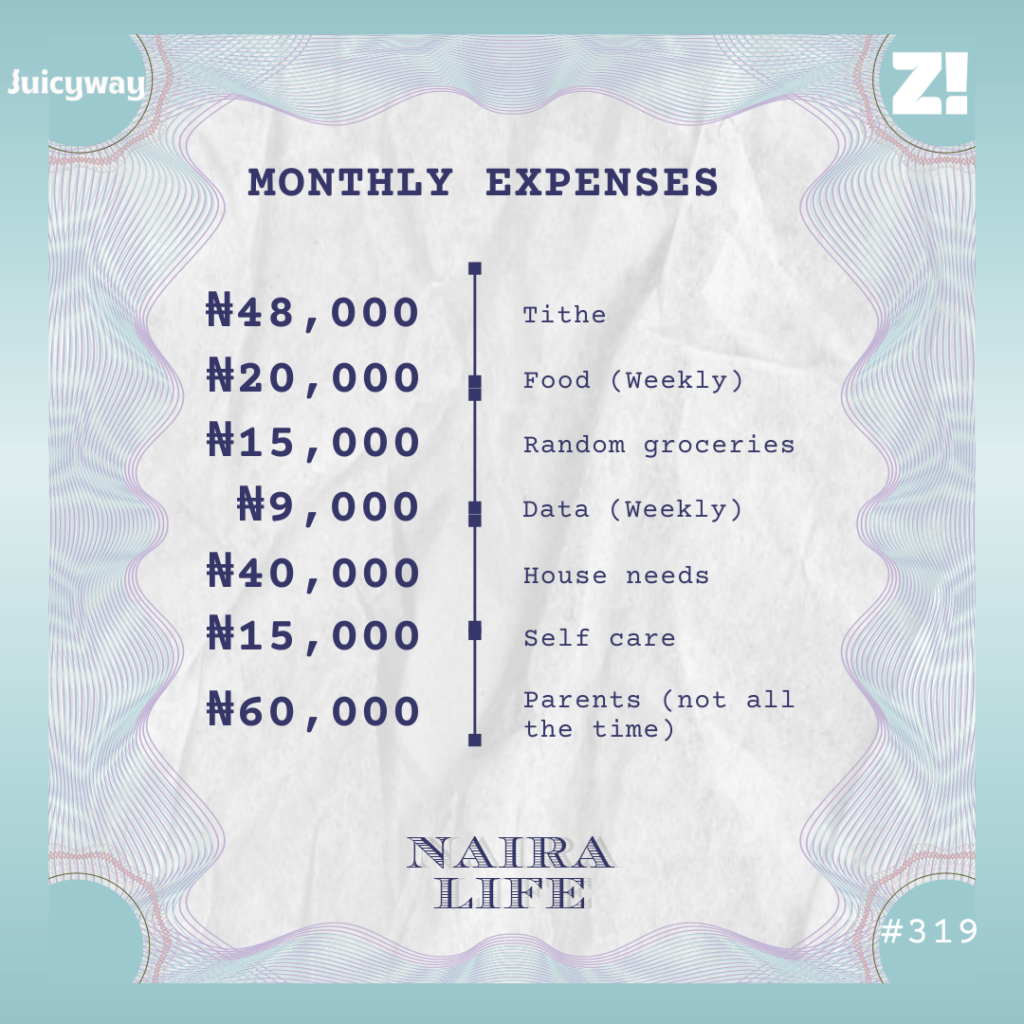

My revenue affords me a very good life. I don’t reside extravagantly, so I can purchase no matter I want or need. That’s normally simply meals, skincare, church choices, and lease. I moved into my very own residence in August 2024, and my lease is ₦500,000 per yr. I additionally often ship cash to my mother and father, however I don’t do it on a month-to-month foundation as a result of then it appears like I’m paying a invoice.

Might you break down these bills for a typical month?

I normally ship my sister cash, nevertheless it’s not fixed because it depends upon what she asks for. The remainder of my cash goes to meals and knowledge.Â

You talked about not changing all of your wage and leaving the remaining within the financial institution

Sure. The $300 is only for month-to-month bills; the remaining is put aside as financial savings. At present, I’ve $6500 in my financial savings account. It could have been extra, however I began my grasp’s diploma final yr and needed to pay for college charges and different bills. To date, I’ve spent ₦700k on the diploma, which included faculty charges and lease.Â

Do you might have plans in your financial savings?

Almost definitely japa for my PhD. My sister had saved cash when she was relocating, and my mother and father didn’t should chip in. That’s my plan too, however I’m sceptical about utilizing all my financial savings to relocate. Let’s see the way it goes, although. I simply wish to depart this nation.

I really feel like I shouldn’t ask why, however I’ll ask anyway. Why?

I’m not residing the very best quality of life doable on this nation. I do know folks go, “When you have cash, you possibly can nonetheless reside on this nation,” however I don’t assume that’s at all times true. It’s the little issues that hold lowering one’s high quality of life.

For instance, I used to be debited twice for a ₦100k transaction final month, and I’ve dragged the problem since then with no decision. I mentioned, okay, let me depart these folks for God and open a brand new checking account. The final time I opened an account was in 100 stage, I didn’t know it could be this tough in 2025.Â

I gathered all of the required documentation and visited the financial institution on two separate events, solely to be informed that there was no community accessible to course of something. Once I returned the next day, they mentioned the NEPA invoice was previous and I would want to come back again with a distinct one, after greater than three days of backwards and forwards.

There are too many examples to provide, however the abstract is that Nigeria retains stressing me out, and even cash isn’t altering it.Â

What was the very last thing you obtain that made you content?

My air fryer. I acquired a $50 bonus at work early this yr, and I used a part of it to buy the air fryer for ₦53k.

How concerning the final buy that required critical planning?

I modified my and my sister’s telephones in December, and I began planning for it in October. Paying for the telephones and receiving them was a really traumatic expertise. They price $600, and I needed to ship the naira equal to my sister’s pal’s sister.Â

She purchased the telephones from a web site after which despatched them by way of a household pal who was returning to Nigeria for Christmas.Â

Out of curiosity. What do you assume the subsequent 5 years appear to be for you?

I believe it’s going to be extra work and faculty for me. I wish to earn a PhD throughout the subsequent 4 years whereas additionally working and making some huge cash. I hope to someday earn sufficient cash to start out my very own firm, permitting me to plan for an early retirement, possible round 50.

What qualifies as “sufficient cash”?

Tons of of thousands and thousands of {dollars}. I don’t have long-term plans, so I don’t have a transparent path to attaining that proper now. It’s not precisely a selected, measurable objective; it’s only a dream, and I believe I can afford to dream.Â

How have your experiences formed your perspective on cash?

I imagine there’s nothing free on this life. In case you work laborious, you’ll have cash. This doesn’t imply individuals who don’t have cash aren’t working laborious, however I imagine it’s a precept that works. In case you work laborious sufficient, you’ll earn cash inside a specified time period.Â

I additionally wish to study to deal with my funds higher. It’s not sufficient to take a seat at my laptop computer and work and work all day lengthy, and spend cash because it comes. I’ve come to grasp I have to discover ways to take calculated dangers and discover useful funding alternatives. I imagine step one is to hunt out academic assets and replace my data, so I understand how to handle my funds successfully. That’s one factor I want to repair.

How would you price your monetary happiness on a scale of 1-10?

8. I can purchase something I would like, and I’m glad sufficient. It’d have been a ten, however I don’t have cash to japa but.

In case you’re taken with speaking about your Naira Life story, it is a good place to start out.

Discover all of the previous Naira Life tales right here.