Bitcoin Margin Trading Guide & Best Exchanges (2024 Updated)

November 10, 2024

What are Ether Rocks? Meet the NFT Digital Rocks Craze

November 10, 2024

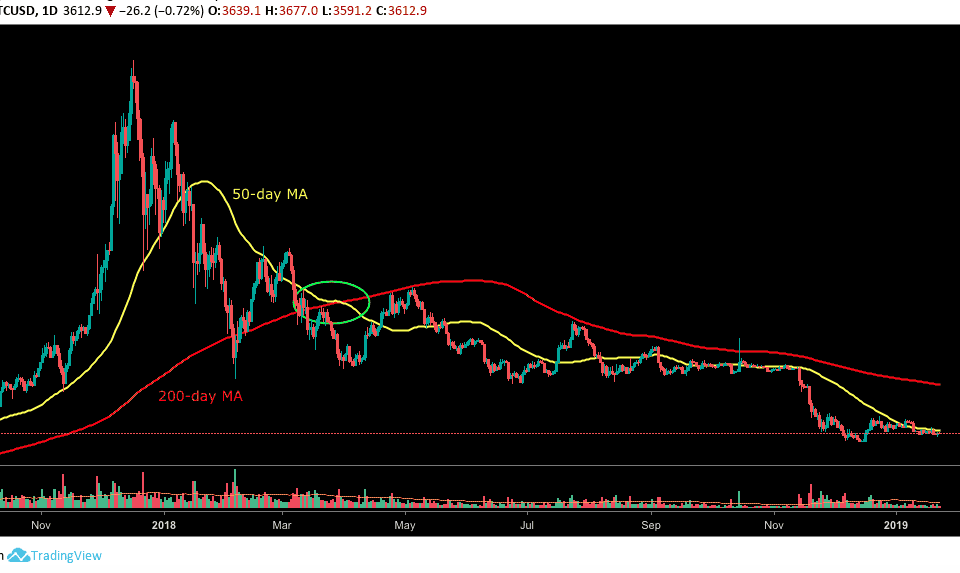

By BitcoinŌĆÖs small-frame chart, one can establish sudden actions or ŌĆśbumpsŌĆÖ in a single route, adopted by consolidation and a sudden ŌĆśbumpŌĆÖ within the different route that ends near the bottom worth.

This phenomenon can even happen in non-crypto belongings, and it has been given the identify ŌĆ£BartsŌĆØ as a result of the assetŌĆÖs worth sample resembles the pinnacle form of the long-lasting Simpsons character, Bart Simpson.

It’s helpful to know the way to acknowledge this sample, as it will possibly considerably have an effect on brief and mid-term buying and selling positions. It seems on account of lots of of Bitcoin orders in a matter of minutes, which might change the worth of the coin. Whereas it will possibly occur to any cryptocurrency, it largely revolves round Bitcoin for a number of causes. One such trigger is BitcoinŌĆÖs ordinary substantial volatility, in addition to the truth that sharp modifications in BTC worth can have an effect on the remainder of the altcoins market as nicely.

The explanation for these sudden pumps and dumps is more likely to burn crypto margin merchants, whether or not brief or lengthy, by manipulating the market. Whereas some imagine that that is carried out by the exchanges themselves ŌĆö which is totally attainable as a result of lack of laws ŌĆö this is perhaps associated to giant crypto merchants, generally generally known as ŌĆśwhales.ŌĆÖ

The sample can be recognized to occur in reverse, leading to an upside-down picture of BartŌĆÖs head the place the drop happens first, after which the spike arrives. This is called a bullish consolidation sample.

The Bart SampleŌĆÖs Results on the Market

Bitcoin ETF: These occasions, amongst others, seemingly contribute to the the reason why the SEC regularly refuses to approve Bitcoin ETFs. Regardless of what traders and merchants imagine, the reality is that the crypto market remains to be skinny and too simply manipulated. Analysts typically are likely to view the crypto markets because the ŌĆ£whalesŌĆÖ playgroundŌĆØ; they’ll deliver forth drops and surges every time they select.

Miner Affection: Particularly in a crypto bear market, as we now have in 2018, the miners stay energetic. Since their objective is to revenue by serving to to take care of the BTC blockchain, they depend upon rewards to pay their electrical energy prices and hold their mining rigs updated. Nonetheless, worth manipulation can even have an effect on them, as low costs of BTC have a tendency to not be sufficient to cowl their fundamental prices.

Buying and selling Tricks to Survive Barts

- In case you are aiming for the center or long-term buying and selling durations, the Barts will have an effect on you much less.

- Brief-term merchants, who are likely to open margin positions on exchanges reminiscent of Bitmex and Bitfinex, may wish to have additional stop-loss orders or liquidation costs.

- Should you establish a sudden transfer adopted by consolidation, contemplate a Bart possibility that can rapidly drive the worth within the different route.

For extra buying and selling suggestions, go to our dealerŌĆÖs guides part.

Binance Free $600 (CryptoPotato Unique): Use this hyperlink to register a brand new account and obtain $600 unique welcome provide on Binance (full particulars).

LIMITED OFFER 2024 at BYDFi Alternate: As much as $2,888 welcome reward, use this hyperlink to register and open a 100 USDT-M place without spending a dime!