10 Signs you are investing in a bad ICO

November 11, 2024

What is Magic Eden? Everything You Need ot Know About Solana’s Leading NFT Marketplace

November 11, 2024

TL;DR

- The demise cross is a generally referenced technical evaluation setup, such a setup happens when the 50-period MA crosses beneath the 200-period MA.

- No setup or methodology is foolproof.

- The Demise Cross and Golden Cross will be topic to fake-outs.

Technical evaluation within the cryptocurrency house, or any marketplace for that matter, is sophisticated. Influencers and analysts typically spout out sufficient phrases and phrases to make a newcomer’s head spin. One such time period is the dreaded “demise cross.”

The demise cross is usually touted as an ominous signal throughout downward crypto value motion, indicating doable additional vital downward motion. The occasion happens on value charts when two particular shifting averages intersect on a path downward.

In technical evaluation, three shifting averages (MA) are generally referenced of their relation to cost: the 50-period MA, the 100-period MA, and the 200-period MA. The 50-day MA and the 200-day MA seem like essentially the most generally used MAs when searching for a demise cross.

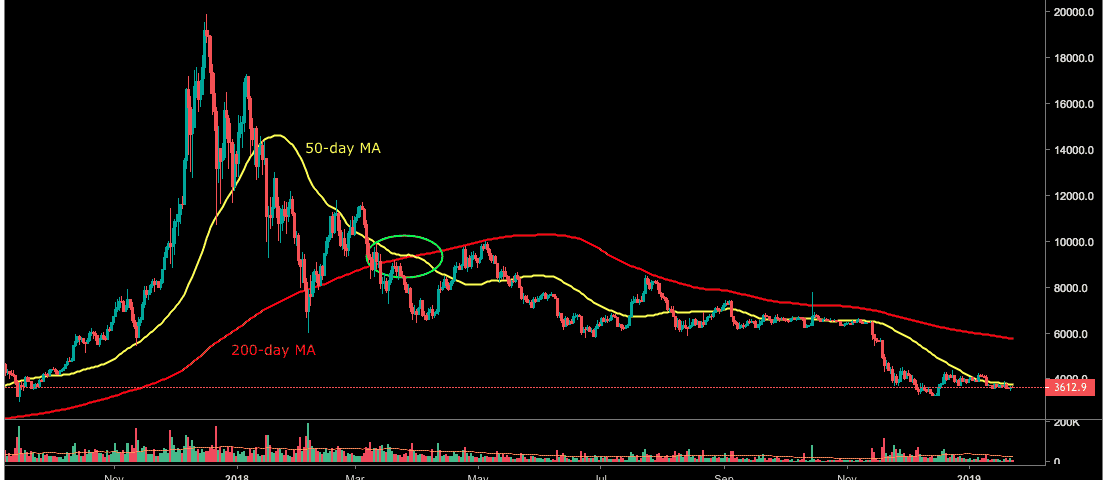

Within the crypto house, bitcoin’s demise cross earlier this 12 months seems to have been a robust turning level for crypto’s beforehand bullish pattern, as seen in bitcoin’s every day Bitfinex chart beneath (with the demise cross circled in inexperienced). Nonetheless, virtually ten months after bitcoin’s every day MA demise cross, the crypto market nonetheless exhibits indicators of an intense bear market.

After the Demise Cross, the worth will be seen approaching the crimson 200-day shifting common a number of occasions, though every try confronted rejection.

Like all technical evaluation device or methodology, the demise cross just isn’t foolproof. Many technical indicators also can fall prey to cost fake-outs.

Bitcoin’s final bear market additionally posted a demise cross. On this instance, nonetheless, the 50-day MA crossed again above the 200-day MA for a while earlier than returning beneath the 200-day MA.

Meet the Golden Cross

Inversely, the Golden Cross happens when the 50-period MA crosses above the 200-period MA, presumably indicating bullish sentiment and future bullish motion.

Even the perfect technical evaluation typically could solely present a slight benefit in anticipating future value motion. Moreover, technical evaluation is a recreation of confluence. Many value clues in congruence typically rule over a single clue.

Binance Free $600 (CryptoPotato Unique): Use this hyperlink to register a brand new account and obtain $600 unique welcome provide on Binance (full particulars).

LIMITED OFFER 2024 at BYDFi Trade: As much as $2,888 welcome reward, use this hyperlink to register and open a 100 USDT-M place free of charge!