What You Need to Know

November 11, 2024

Which Blockchain is Better for Minting NFTs?

November 11, 2024

TL;DR

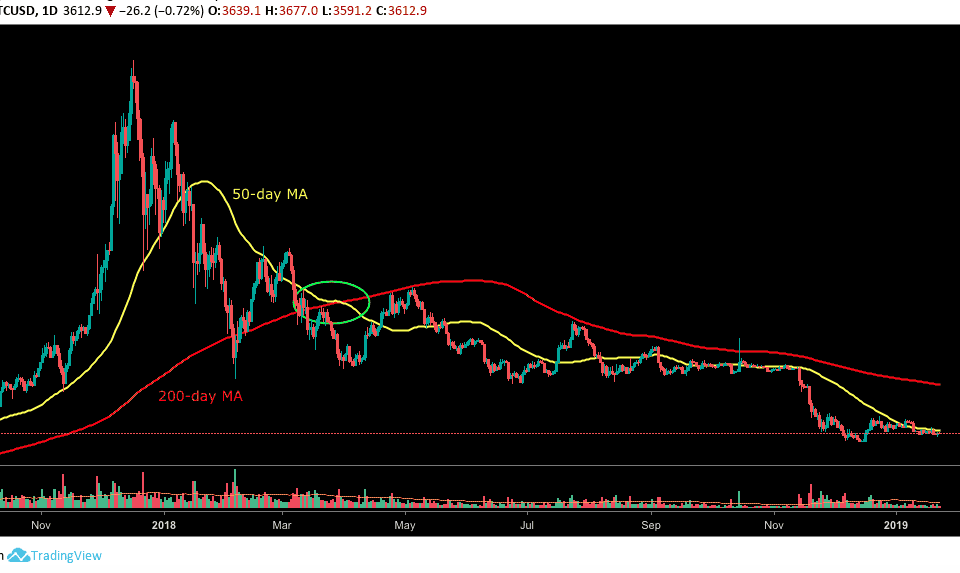

- Value divergence – bearish and bullish – within the crypto house can typically decide future value course.

- Increased chart time frames typically yield stronger, extra impactful outcomes.

- Combining market alerts for confluence might be necessary when conducting technical.

Everybody in crypto needs a solution to the golden query: The place will the Bitcoin value go subsequent? Though nobody really is aware of future value motion till it occurs, value divergence can typically assist reply that query.

Divergence happens when the worth makes larger highs whereas indicators paint decrease lows or vice versa. Merely put, divergence is when value course contradicts indicator course, making a noticeable conflicting sample.

Â

The Bitcoin day by day chart pictured above reveals a bullish divergence between value motion and the Relative Power Index (RSI – Purple line). Value confirmed a transparent downward pattern, whereas the RSI confirmed an upward pattern. Which means that though the worth could also be falling, market sentiment is gaining power.

Â

This idea additionally works oppositely, as seen in one other day by day bitcoin chart instance above. A particular bearish divergence was seen throughout bitcoin’s climb to interrupt new all-time excessive costs twice: Nov-Dec 2017, when BTC climbed in the direction of $20K and misplaced over 80% in 12 months, and likewise through the present ATH round $65K, which was recorded on April 2021.

In each circumstances, as the worth climbed towards its peak, the RSI posted a downward sample, indicating a market reversal – or bearish divergence.

Â

As with many chart patterns and ideas, divergences have to be famous relating to their time frames. Divergences can typically be noticed in many alternative time frames, even together with short-term charts just like the 15-minute chart, though it is very important be aware that larger time frames typically have extra weight and impression. In different phrases, it may be straightforward to overlook the larger image whereas being too targeted on the current.

The second widespread kind of divergence is the hidden one. In contrast to common divergence, which spots pattern reversal, hidden divergence spots pattern continuation.

Please check with the next divergence cheat sheet. As you possibly can see, bullish/bearish hidden divergence happens when the worth makes decrease/larger lows, and the indicator makes larger/decrease lows.

Not On The Divergence Alone

Moreover, it’s important to use the idea of divergence with different elements, akin to help and resistance ranges or transferring averages. Technical evaluation in Bitcoin and crypto is usually a sport of confluence. One view or indicator by itself typically might be deceptive. Utilizing a number of strategies collectively, nevertheless, can typically be more practical.

It’s also necessary to notice that nothing is assured (in any other case, everyone seems to be wealthy). Value could make surprising strikes, even relating to bigger time frames with a number of alerts of confluence. Even textbook performs can take surprising turns.

Binance Free $600 (CryptoPotato Unique): Use this hyperlink to register a brand new account and obtain $600 unique welcome provide on Binance (full particulars).

LIMITED OFFER 2024 at BYDFi Trade: As much as $2,888 welcome reward, use this hyperlink to register and open a 100 USDT-M place without cost!