10 keys for evaluating Initial Coin Offering

November 11, 2024

Everything You Need to Know

November 11, 2024

In lots of areas of life, dimension usually impacts the result of an occasion: a big bus, for instance, will inflict extra vital harm on a brick wall than a go-kart. Equally, quantity impacts cryptocurrency buying and selling.

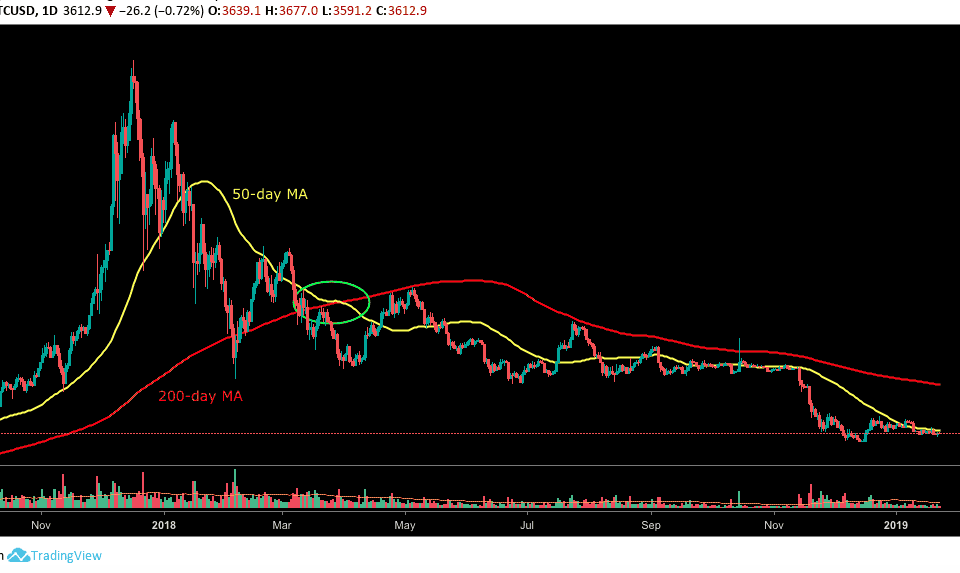

Buying and selling quantity normally could be seen as the underside vertical bars on value charts. Evaluating the peak of these bars to one another can present the quantity’s exercise relative to different factors within the asset’s value timeline. Since these charts are sometimes particular to only one alternate, one may additionally go to alternate knowledge aggregators corresponding to CoinMarketCap to see the general asset buying and selling quantity numbers, as exchanges can noticeably differ in quantity, relying on the alternate.

On the time of this writing, for instance, Bitcoin posted a bit greater than $10 billion in quantity over the previous 24-hour interval, in accordance to CoinMarketCap. CoinBene tallied near 4% of that quantity, at roughly $477 million.

What does excessive buying and selling quantity imply?

Excessive buying and selling quantity can imply vital cash circulate and curiosity in a given asset. When Bitcoin’s buying and selling quantity picks up, for instance, it may possibly point out that extra persons are buying and selling the asset or are investing cash in it. Quantity can generally be used to gauge curiosity and a focus. Quantity can apply to all belongings, however for simplicity, Bitcoin is used, for instance, on this article.

Bitcoin posted vital quantity close to the tip of 2017 when the mainstream public noticed seemingly fixed discuss Bitcoin, and the asset posted astronomic value positive factors. Equally, Bitcoin’s value crash in 2018 additionally noticed vital quantity, however this time sellers’ quantity (crimson candles).

In distinction, in comparison with the bull run and the next crash, Bitcoin seemingly noticed significantly much less quantity throughout its lull in volatility within the fall of 2018, in line with the introduced TradingView’s Coinbase weekly candle chart.

Moreover, the quantity can provide extra significance to cost actions and present they’re extra significant concerning future strikes and general tendencies.

Divergence

Along with basic info, quantity can generally appear to trace towards a change in development. Divergence is usually talked about within the case of the Relative Energy Index (RSI). Divergence, nonetheless, may also generally apply to buying and selling quantity. As proven on Bitcoin’s every day candle chart, Bitcoin’s value posted an rising value, whereas the quantity seems to indicate a lowering development (lowering quantity of patrons). Worth then fell afterward.

Dramatic Worth Strikes

When the quantity is low, it may possibly generally go away the market susceptible to vital value swings. Logically, this may be as a result of skinny order of books. If the every day Bitcoin buying and selling quantity is low, it would imply the order books are skinny, missing sufficient accessible orders on the present value to fulfill an enormous vendor or purchaser. If one large order comes via and buys or sells all the asset inside shut value proximity (buys or sells the partitions), then it may possibly trigger slippage, and the worth can react dramatically in response.

Altcoins Quantity

Quantity can turn out to be particularly pertinent when talking about altcoin buying and selling. If a coin or token isn’t getting a lot every day quantity, it may possibly turn out to be difficult to unload or scale out of a extra substantial place as a result of not sufficient patrons could also be accessible.

The value would possibly present an altcoin at $0.10 per coin. But when that coin doesn’t have a lot quantity, there would possibly solely be a small quantity, or promote orders would possibly stagnate at that value. Subsequent orders could be notably decrease, inflicting slippage and a value drop if an enormous vendor (“a whale”) tries to liquidate a big place without delay. That vendor’s asset liquidation may additionally finish in cash loss for the vendor, promoting to orders noticeably decrease than the preliminary $0.10 orders as a result of no orders nearer in value could also be accessible.

Meet The Quantity Technical Indicators

On Steadiness Quantity (OBV)

A few volume-based indicators could be helpful within the crypto house. One such indicator is the On Steadiness Quantity (OBV) indicator. OBV helps current the stream of quantity regarding value tendencies or actions. Divergences concerning the value can generally be seen with OBV.

Chaikin Cash Movement (CMF)

The Chaikin Cash Movement (CMF) indicator is one other attention-grabbing indicator that gauges the quantity of cash motion in particular time segments. Divergences within the CMF indicator can be seen compared to value.

The Backside Line

It’s also essential to notice that no system or indicator is foolproof. Pretend-outs and false indicators or break-outs do happen. It may be useful to take a number of completely different time frames into consideration, in addition to discover congruence with multiple indicator or sign. A large number of patterns and indicators exist in crypto. The dying cross, triangles, and wedges are only a few of such examples. Merchants ought to develop and be taught what works for his or her private buying and selling system.

Binance Free $600 (CryptoPotato Unique): Use this hyperlink to register a brand new account and obtain $600 unique welcome provide on Binance (full particulars).

LIMITED OFFER 2024 at BYDFi Trade: As much as $2,888 welcome reward, use this hyperlink to register and open a 100 USDT-M place without cost!