Best DeFi Wallets for 2024: Top 13 Reviewed

November 10, 2024

What is Azuki? All You Need to Know About the NFT Collection

November 10, 2024

The Stochastic Relative Power Index, or Stoch RSI for brief, is a widely known momentum technical indicator within the crypto buying and selling world and on the whole buying and selling. The Stoch RSI makes use of facets from each the Stochastic indicator and the RSI indicator. Basically, the Stoch RSI is the Stochastic indicator, with motion primarily based on RSI ranges rather than worth ranges.

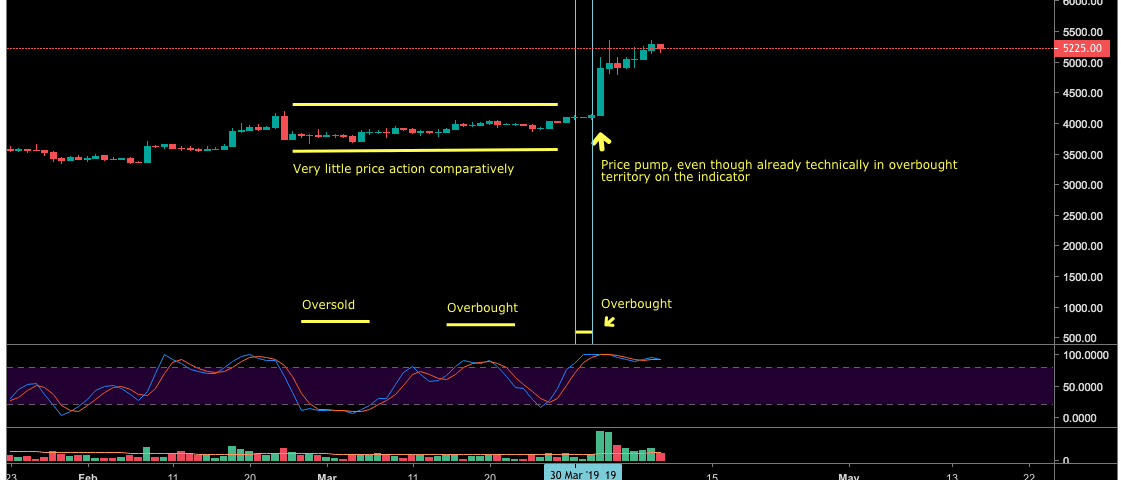

The Stoch RSI, at face worth, consists of a numerical vary of 0 to 100. The indicator comes normal with dotted strains at each 20 and 80. Sometimes, any motion over the 80 vary is labeled as “overbought territory,” and something beneath 20 is considered “oversold.”

The Stoch RSI additionally has two interacting strains, labeled Ok and D. On the Stoch RSI, these values each come normal at a worth of three, with RSI and Stochastic lengths each at 14. Compared, the common stochastic indicator has strains known as %Ok and %D, with values of 14 at 3, respectively, and a clean worth enter of three.

Faux-outs

Utilizing the Stoch RSI indicator when it comes to easy overbought and oversold situations could be troublesome, offering many fakeouts and false alerts. The indicator can also keep in these excessive and low ranges for prolonged durations of time.

Durations Of Overbought/Oversold

Generally, nevertheless, it may be helpful to notice durations of overbought or oversold ranges when used together with different analyses and indicators. Using a number of indicators, observations, and strategies may help come to a extra well-rounded conclusion. It’s important to not take anyone indication as truth {that a} specific end result will certainly happen and to weigh a number of choices and viewpoints.

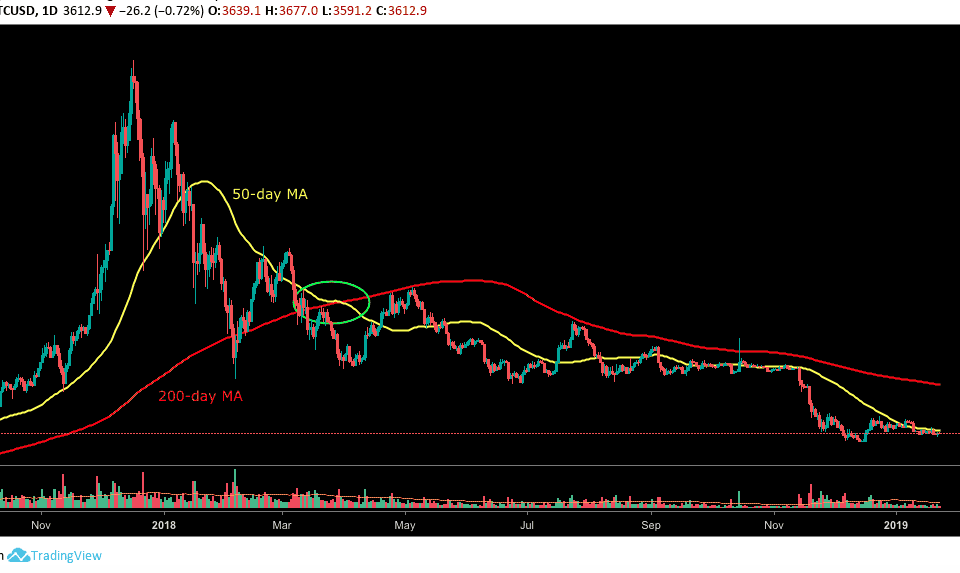

Divergence

As with a number of indicators, merchants generally can use the Stoch RSI to identify divergences between the indicator and worth, gauging underlying momentum. Such divergences can generally result in a change in worth path.

Merchants could, at occasions, additionally discover it helpful to acknowledge how the 2 Stoch RSI indicator strains work together as they cross over one another at various factors regarding worth.

*This text and its charts comprise opinions and interpretations from the writer and shouldn’t be taken as any recommendation.

Binance Free $600 (CryptoPotato Unique): Use this hyperlink to register a brand new account and obtain $600 unique welcome provide on Binance (full particulars).

LIMITED OFFER 2024 at BYDFi Change: As much as $2,888 welcome reward, use this hyperlink to register and open a 100 USDT-M place without cost!