Is It The Best Trading Strategy For Bull Runs?

November 10, 2024

Okay Bears NFT Collection: The Complete Guide

November 11, 2024

There are numerous methods during which cryptocurrency buying and selling resembles conventional ones, however there are simply as many variations as properly. That’s why it’s potential to make use of common definitions, however they should be appropriately adjusted and associated in response to the specifics of cryptocurrencies.

Worth gaps, for instance, are one thing seen fairly frequently inside conventional markets, and we are able to already see them turning into an element to contemplate with regards to Bitcoin value evaluation as properly.

What Are Worth Gaps?

A niche is an space of the chart the place an asset’s value both rises or falls from the day past’s shut with none buying and selling occurring in between.

Most people who find themselves conscious of Bitcoin would rightly assume that this can’t occur with the most important cryptocurrency by market cap. In any case, the crypto market doesn’t cease buying and selling on Friday – it’s a continuous 24/7 showdown.

Right here’s the place Bitcoin’s progress over the previous couple of years involves play. What’s new is that there are additionally USA authorized Bitcoin ETFs, you’ll be able to verify them out by following the hyperlink.

Gaps In Bitcoin’s Charts

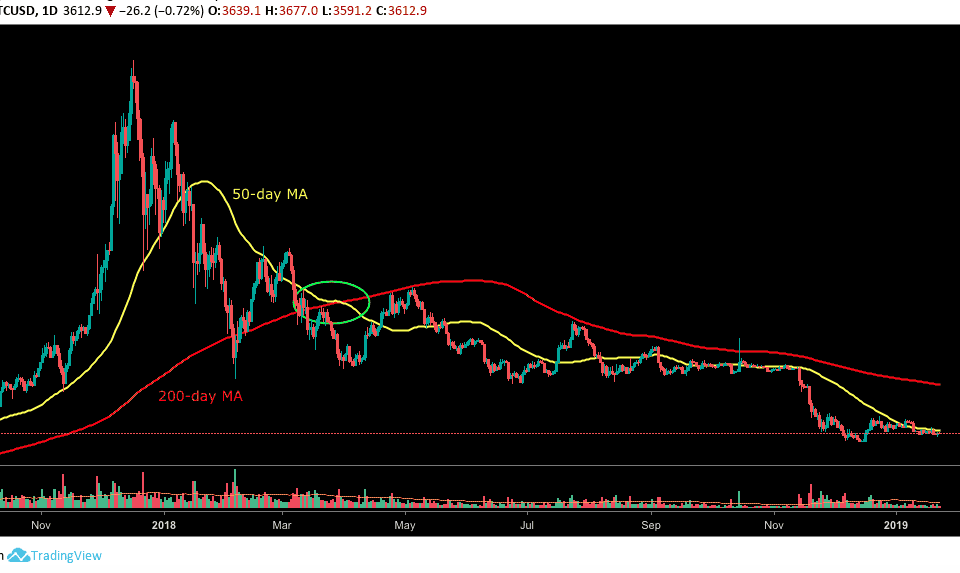

Again in 2017, Bitcoin reached almost $20,000 in a parabolic rally, which caught the eye of the world. Not solely traders have been serious about it, although, as so have been different main institutional gamers on the earth of buying and selling.

Roughly at the moment, two new Chicago-based brokers launched for Bitcoin futures – permitting contracts to be cash-settled in opposition to the USD. The primary got here on behalf of the Chicago Mercantile Alternate (CME), and the second from the Chicago Board Choices Alternate (CBOE).

As a result of CME and CBOE are regulated institutions, they function and commerce between sure hours on weekdays. Whereas the latter not provides Bitcoin futures, the previous does, and it has its working hours – Sunday by Friday, from 5 p.m. to 4 p.m. US central time.

Regardless that CME closes each week on Friday, Bitcoin doesn’t keep nonetheless. Among the most dramatic unstable value actions seem exactly on the weekends. So, what occurs if arbitrage creates these value gaps?

Â

As we are able to see within the instance above, a number of weeks in the past, a notable hole appeared when Bitcoin skyrocketed to over $10,000 in just some hours. One other hole might be noticed from September when CME closed at $10,150 and needed to open at over $10,400 on the next Monday. So, what occurs in such instances?

Do Bitcoin Worth Gaps All the time Get Stuffed?

Whereas there are a number of instances when gaps stay open, most occasions, they shut typically within the following short-term future. A really complete thread exhibits that out of 100-weekend gaps, 95 crammed or closed. In accordance with the stats, 50 closed on the opening day and 28 inside the identical week.

Â

On the each day chart, we are able to discover a number of examples of how the value has closed the earlier hole. Typically it’s even by a sudden sharp motion that leads to a candle’s wick, whereas different occasions, the value fills the hole.

Why Worth Gaps Get Stuffed?

There are a number of potential explanations of why most gaps get crammed. For starters, if the spike was too optimistic or pessimistic, it might result in a correction. One other potential motive would possibly come if the value motion was fairly sharp, then it doesn’t depart any help or resistance, making the correction extra prone to occur and thus fill the open hole.

Do Gaps Impression Bitcoin’s Worth?

This query may very well be accepted as a grey space among the many crypto group. Whereas there’s no laborious proof that Bitcoin’s value is straight affected by the gaps, plenty of individuals in the neighborhood appear to imagine so.

Particularly in instances the place the value on CME Bitcoin Futures chart flash crashes in simply seconds, a number of the most notable analysts within the trade argue for potential manipulation.

I can’t imagine how loopy buying and selling BTCUSD on the brief time period is true now. The hole on the CME has crammed already. It’s thinly traded sure. However man, I’m extremely suspicious of the value motion throughout all of the exchanges of late, extra so than ordinary. http://t.co/M3Pf4Cmksq

— Willy Woo (@woonomic) November 5, 2019

Can Merchants Profit From Bitcoin Worth Gaps?

When taking a look at these gaps, one would possibly conclude that they are going to be crammed rapidly inside the subsequent few days. Some merchants even depend on this technique when analyzing the charts. Nonetheless, this may very well be fairly a harmful endeavor if not executed correctly.

Inside the conventional market, it may very well be extra clear. For instance, some merchants would possibly purchase inventory in after-hours buying and selling if the corporate releases a constructive earnings report and expects a value improve. Nonetheless, since Bitcoin doesn’t cease buying and selling on different exchanges, this may very well be trickier within the cryptocurrency world.

From a technical standpoint, when a major hole seems, it removes the fast help or resistance, and the hole is extra prone to fill.

Different gaps’ normal guidelines of thumb would possibly embrace:

- The commerce must be within the general path of the value on the next timeframe (at the very least 4 hours).

- The worth ought to retrace to the unique resistance stage. This means that the hole is crammed, and the value returns to prior resistance turned help.

- The danger administration must be symmetrical – 1:1, since virtually all gaps shut.

Conclusion

Gaps happen when the value of an asset opens greater or decrease after the final buying and selling day. They began showing on the chart of the most important cryptocurrency after CME launched Bitcoin Futures contracts in late 2017. As per the charts, most gaps are crammed inside the first week, however there are instances when they’re left open. Whereas they might seem to be a simple and worthwhile commerce, the dangers must be thought of as properly.

Binance Free $600 (CryptoPotato Unique): Use this hyperlink to register a brand new account and obtain $600 unique welcome supply on Binance (full particulars).

LIMITED OFFER 2024 at BYDFi Alternate: As much as $2,888 welcome reward, use this hyperlink to register and open a 100 USDT-M place without cost!